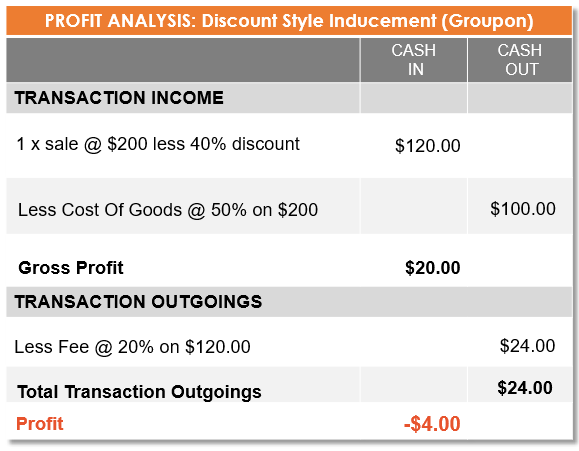

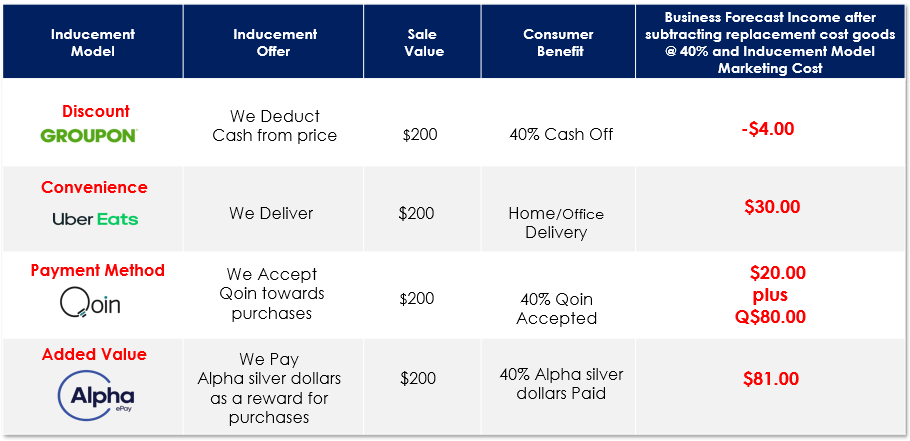

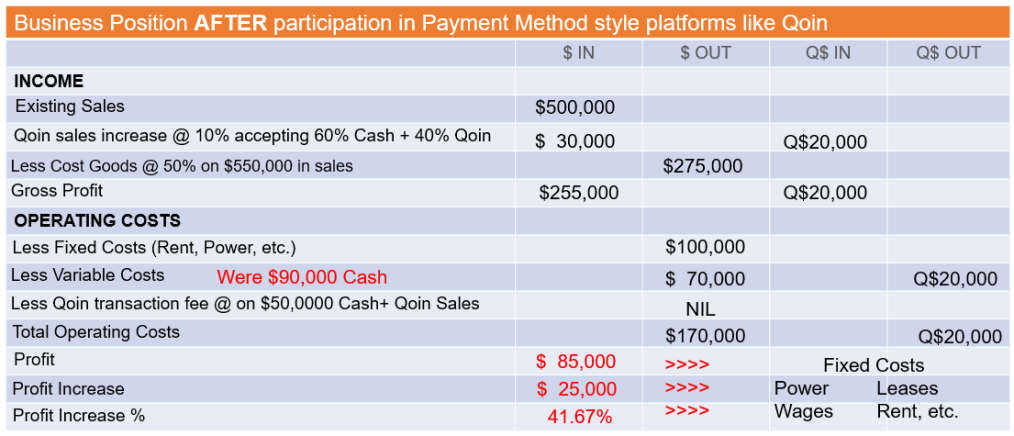

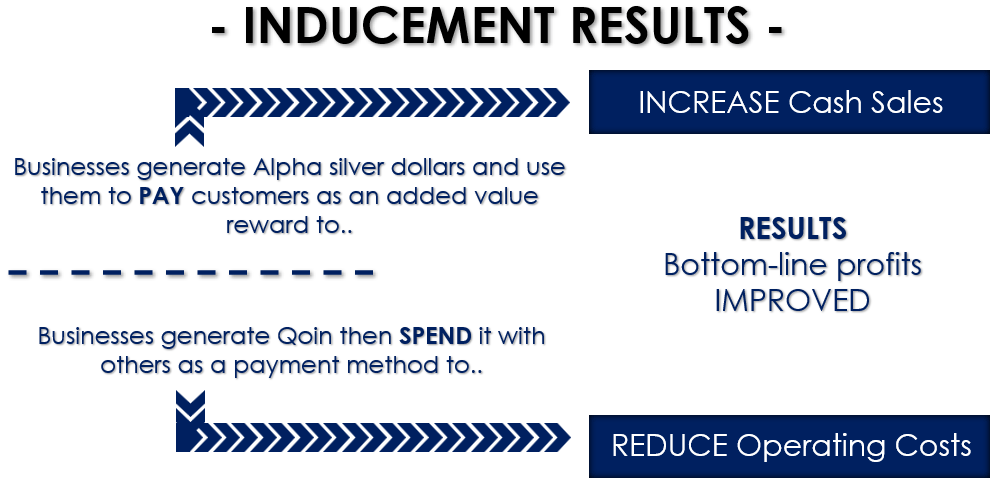

(NB. The key benefit in accepting alternative currencies like Qoin to improve bottom-line profits is how a business uses this incremental income. In this example the business accepts the Q$20,000 Qoin as a method of payment to incentivise $50,000 in purchases and then uses the Q$20,000 Qoin to offset against its Variable Costs in order to Reduce Operating Costs.)

▪ Less Cost Goods @ 50% on $550,000 sales value equals $275,000 leaving a Gross Profit of $255,000.

OPERATING COSTS

▪ Less Fixed Costs, apportioned to mortgage, phone, power, leasing, wages, etc., $100,000.

▪ Less Variable Costs, apportioned to printing, freight, packaging, chemicals, building maintenance, vehicle maintenance, sign writing, etc. totaling $90,000 and paid $70,000 in Cash and Q$20,000 in Qoin.

▪ Less Qoin transaction fee for generating the sales increase of $50,000 being zero give a Total Operating Cost of $170,00 Cash and Q$20,00 Qoin.

▪ After the Total Operating Costs of $170,000 Cash and Q$20,00 Qoin are deduct the Gross Profit of $255,000 Cash and Q$20,00 Qoin we find the business generated Profit of $85,000, a Profit Increase of $25,000 or 41.67% over and above the Present Condition example.